Does windstorm insurance in Texas require a certificate of compliance? The answer is yes, but how do you find out if your home is covered? Texas requires that homes be windstorm-proofed when they are built and when the house has been certified by the Texas Department of Insurance. Check with previous owners for certificates or call TWIA and they can help you find one if you don’t have it.

Rates

The TWIA Board of Directors recently narrowly approved a 10-percent increase for windstorm insurance rates in Texas. The increase would affect all new and renewing policies for residential and commercial properties. The increase could mean a major insurance rate hike for homeowners on the Gulf Coast. The board argues that the increase is needed to cover costs of repairing damaged structures and paying claims. TWIA does not use credit scoring in determining rates, but it does include a 4 percent cost-of-living adjustment.

The Texas Windstorm Insurance Association (TWIA) is the last resort for citizens who don’t have private coverage. This association is called the “pool” because of its tenth-percent ratio of assets to exposure. To fix TWIA, state policyholders must accept the premise that major hurricanes will affect the entire state. Katrina, which destroyed much of Louisiana and northern Mississippi, proved this adage.

Criteria to qualify for coverage

Are you looking for a windstorm insurance policy for your home in Texas? If so, you should be aware of the criteria that must be met. These include being in a flood-prone area and meeting certain underwriting requirements. Fortunately, there are some ways you can satisfy these requirements, and get the windstorm insurance coverage that you need. Read on to learn more. Below are some of the most important ones.

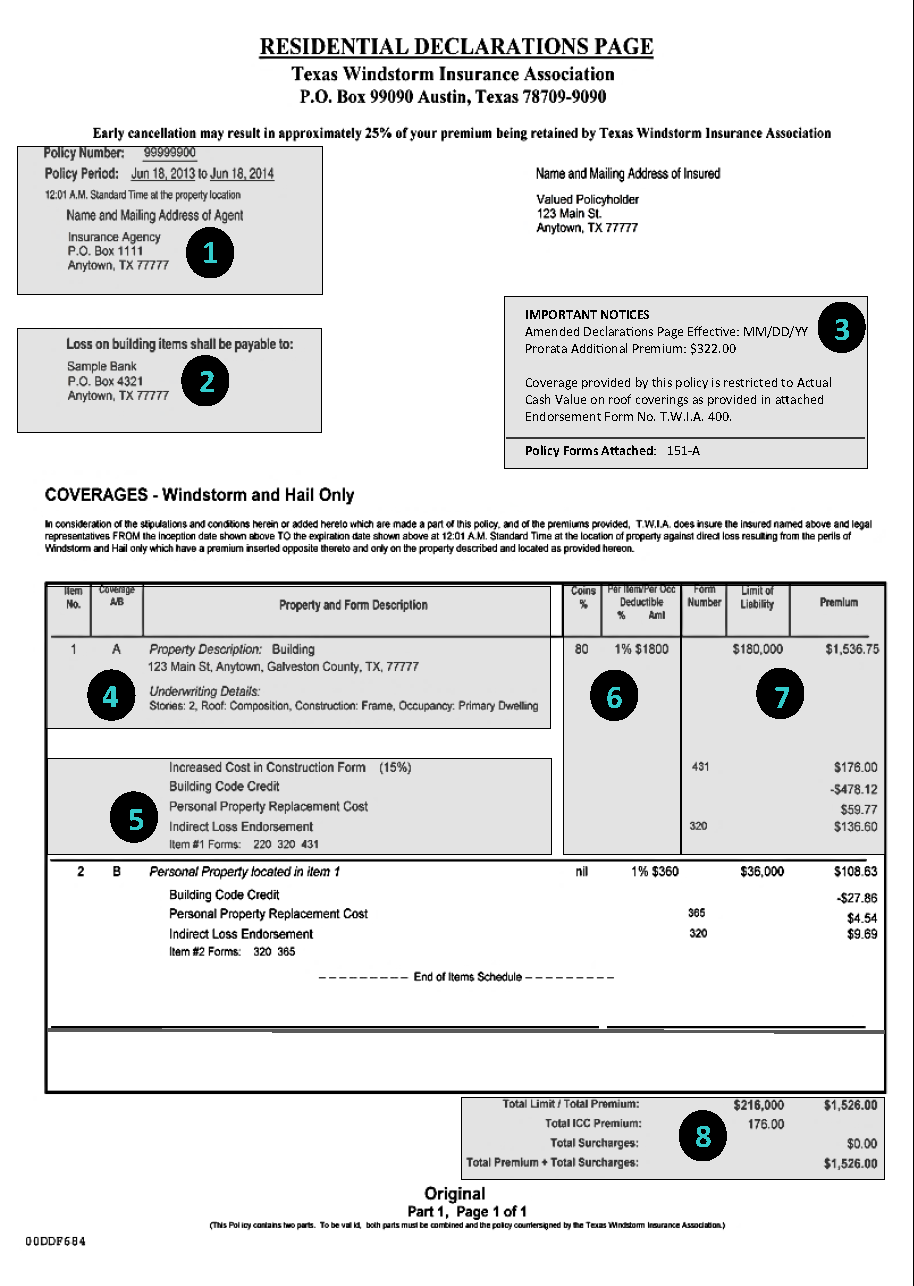

The amount of deductible that must be paid is dependent on the state law in your state. There are laws that determine how much you have to pay in deductibles and how much your insurance company covers. Many policies require you to pay a certain percentage or fixed amount. If you have a higher deductible, you might want to consider a higher premium, but this is not necessary for a standard policy.

Cost

The cost of windstorm insurance is dependent on several factors, including the age of your home, the amount you’ll need to rebuild after a windstorm, and your location. In general, the higher the deductible, the lower your premium will be. If you live in an area prone to hurricanes, you’ll want to purchase higher-level coverage. Besides, it’s much cheaper to purchase windstorm insurance than to pay to repair or rebuild your home yourself.

The amount of windstorm insurance varies greatly, so it’s important to shop around before you decide on a plan. Many homeowners insurance policies require a deductible that’s between one and ten percent of the total insured value. That means if you own a $350,000 home, you’d have to pay anywhere from $3,500 to $35,000. Some states also have a named-storm deductible, which can increase your premium.

Alternatives to TWIA

In Texas, if you’re looking for homeowner’s insurance, you should consider the TWIA. As the insurer of last resort in coastal counties, TWIA is available to residents of the state. But, unlike most insurance plans, TWIA doesn’t cover flood and storm surge damage. If you live in a coastal county, TWIA coverage can be more expensive than other policies. In Texas, however, there are a number of alternatives to TWIA that can help you get the coverage you need for your home.

TWIA is funded by the citizens of Texas. It can only issue bonds if it can generate sufficient funds to cover claims. In addition to its bond issuance process, the TWIA can only issue these bonds when it is expected to be hit by a major hurricane. This way, it is unlikely to run out of money during a catastrophic event. Alternatively, TWIA can sell bonds to generate funds to cover its claim obligations.