In Florida, a property insurance policy must cover windstorm damage. However, obtaining a policy in higher-risk regions may be a challenge. Regardless, it’s still a wise investment to get coverage for your property. Depending on your insurance needs, the supplemental coverage from windstorm insurance can make all the difference. Listed below are some of the benefits that policyholders receive. In addition, read on to learn about the exclusions and rates.

Policyholders receive supplemental coverage for damage caused by windy weather patterns

Windstorm insurance protects homes and other property against the devastation caused by windy weather patterns. Florida has experienced hurricanes in every region since 1850, and inland areas are at risk from tropical cyclones as well. Property insurance for Florida homes is the best way to protect against these damages. To get a quote for home insurance in Florida, use a service like Insurify.

Rates vary depending on location

If you live in an area prone to hurricanes, windstorm insurance can be a good idea. However, the rate you pay will depend on your state laws. For instance, some states have named storm deductibles, while the District of Columbia does not. Regardless of your state, you should make sure you know what you are signing up for. Rates for windstorm insurance vary depending on location, so be sure to ask your agent or broker about this specific coverage.

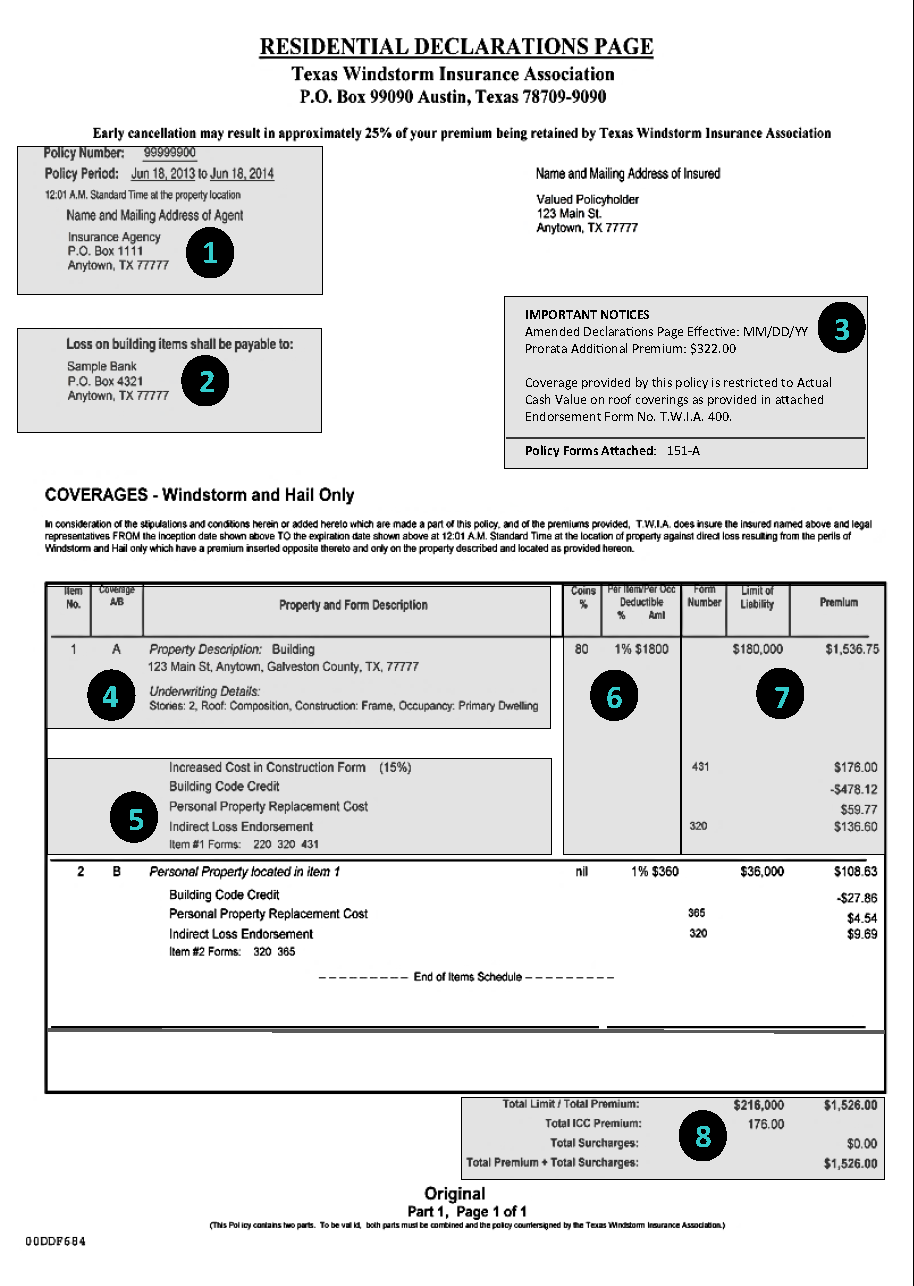

Another important consideration when looking for windstorm insurance is the deductible you choose. In most cases, a deductible is a percentage of the value of your home. A typical deductible is one to ten percent of the value of your home. For example, if you own a $350,000 house, you may need to pay between $3,500 and $35,000. Some companies will let you choose a dollar-based deductible, but this is typically associated with higher premiums.

Exclusions apply

While most homeowners insurance policies in Florida include windstorm coverage, those in high-risk areas should buy separate coverage. Such areas include coastal properties that are beachfront or within 1,500 feet of a body of water. Fortunately, windstorm insurance in Florida is available through Citizens Insurance, the state’s insurer of last resort. However, deductibles may be high, and homeowners in such areas should carefully review them.

For example, Florida residents are responsible for a hurricane deductible when a storm warning is issued. This deductible is high, but it may be worth it if you’re not at risk for hurricanes. Hurricane deductibles usually apply only to damage caused by named storms. State windpools should have rules about when each one applies. If you live in an area that is subject to hurricane-related wind damage, it might be worth considering a state-managed insurance pool such as USAA.