Getting a windstorm certificate is a legal requirement when you purchase a new home in Texas. It will ensure that your home is built to withstand strong winds and keep you and your family safe from damage. You can obtain this certificate by following a few simple steps. Listed below are some benefits of windstorm insurance and the costs involved. Read on to learn more about this important insurance policy.

Getting a windstorm certificate

If you own a property in Harris County, Texas, you should always check if it has a windstorm certificate. Although most homeowners have insurance policies, these policies typically do not cover flood or storm damage. The lack of windstorm coverage in many homeowner’s policies was brought to light during Hurricanes Katrina and Rita, which left homeowners without insurance with no recourse. Now, hurricane-prone areas in Texas require windstorm insurance certificates to protect against high-risk storm damage.

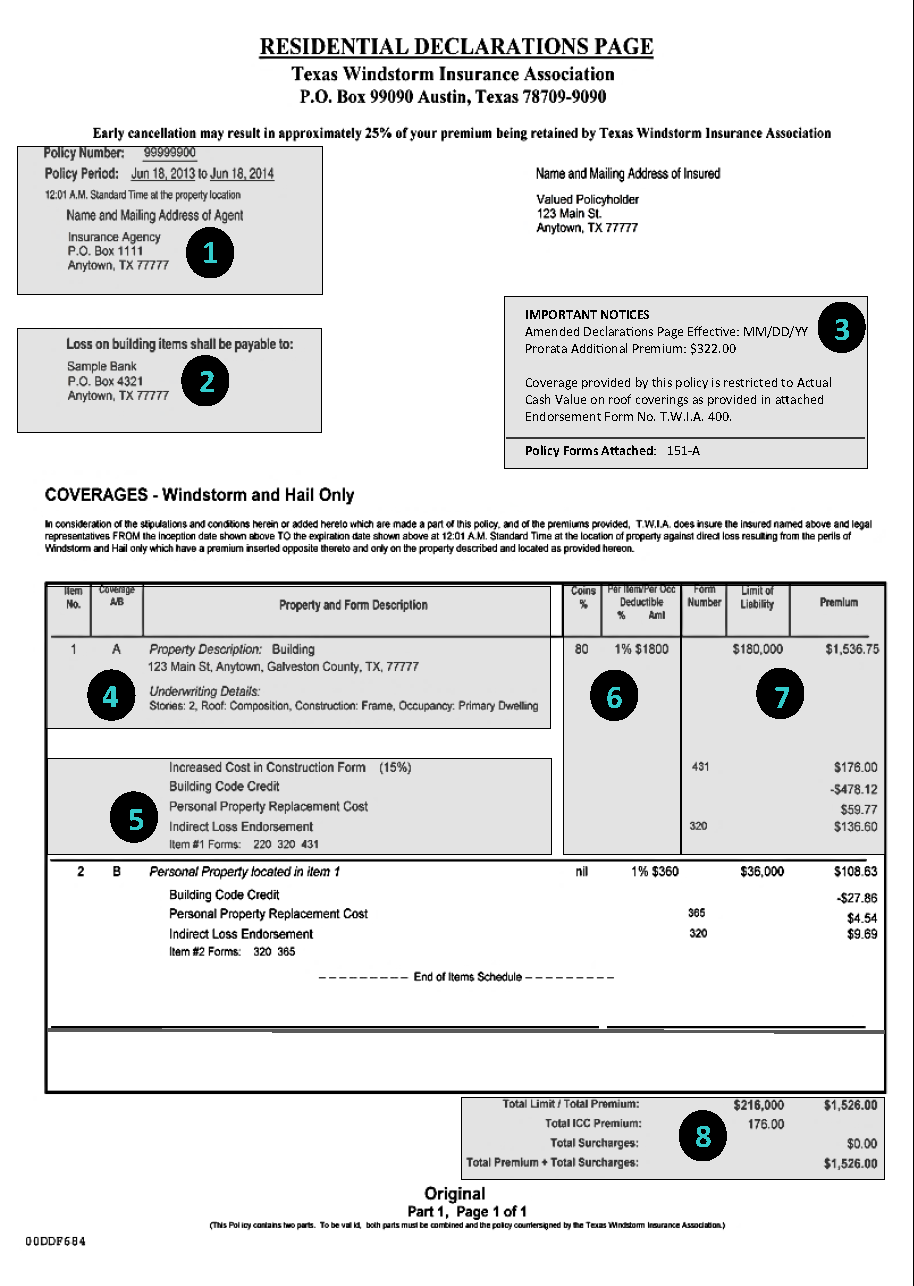

To get your Texas windstorm certificate, you must first get a WPI-8 or a WPI-8C from the Texas Department of Insurance. These documents are proof that your home or business has been properly built and repaired. This certification allows you to obtain insurance for your property. Additionally, if your home has been built and renovated within the last five years, you will also need to get a PC436 (WPI-2-BC-7) inspection verification from the Texas Windstorm Insurance Association.

Cost of obtaining a windstorm certificate

A windstorm certificate is required for certain properties in Texas. The Texas Department of Insurance issues the WPI-8 or WPI-8E certification for those properties. Before purchasing a windstorm certificate, you must check that the property complies with Texas windstorm building codes. If it does not, you will need to purchase flood insurance to cover the costs of hurricane damage. If you do not own a windstorm certificate, you will need to contact the Texas Windstorm Insurance Association for approval.

A TDI inspector will typically respond within 48 hours, although larger storms can delay the process. Since TDI does not regulate the fees charged by engineers, they may not be able to meet your timeline. If your property does not pass inspection, you should post a notice that shows any issues. Once these issues are resolved, the inspector will return to check. Obtaining a windstorm certificate in Texas is not a complex process.

Alternatives to windstorm insurance

When it comes to protecting your home from the effects of hurricanes and other severe weather events, windstorm insurance in Texas can be a great option. Whether you live in the coastal area or not, Texas is prone to windstorms, and a standard homeowner’s insurance policy typically covers wind damage. But some homeowners are at higher risk than others, and it is important to choose a policy that is tailored to your needs.

While the Texas Windstorm Insurance Association (TWIA) may be a great place to purchase wind coverage for your home, you can also opt for the private market. This option provides homeowners with comprehensive wind coverage and is available at a low price. You may be required to purchase a TWIA policy, but these policies are typically more expensive and provide less coverage than private policies. While they are a good alternative, they may not be as comprehensive as you need for the protection you need.